The Post-COVID Decline in User Searches for Hotels

While COVID-19 seems far in the past now, we are still seeing the effects of the pandemic socially and economically, with the hospitality industry being one of the most affected industries as a result of the virus. Starting around January 2020, the outbreak of COVID-19 shocked the world with a number of cases coming forward across the globe. On March 11 2020, after more than 118,000 cases in 114 countries and 4,291 deaths, the WHO declared COVID-19 a pandemic and in the same month travel restrictions and social distancing criteria were put in place. While this had huge effects socially, it also presented huge issues for the hospitality industry as a whole. Now, a few years on, we are looking at the impact of the COVID-19 pandemic and the decline in user searches for hotels across the UK.

Below, we’re going to take a closer look at 10 of the most searched locations and analyse how and why their searches haven’t returned to pre-pandemic levels with some advice on how to rectify this.

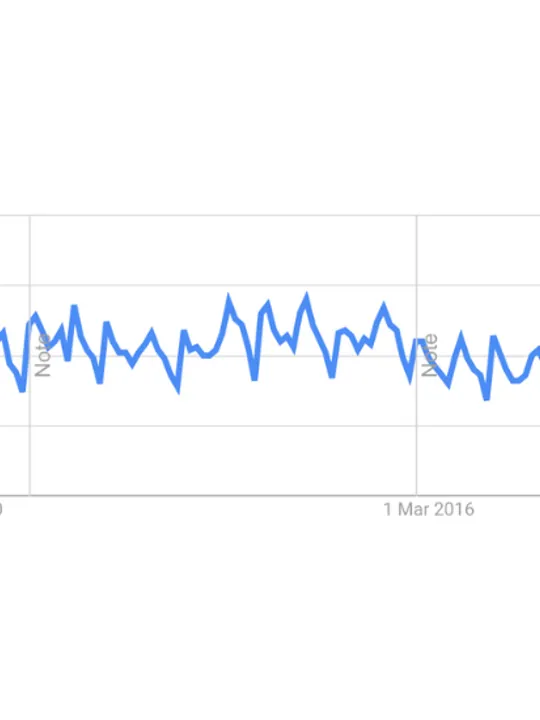

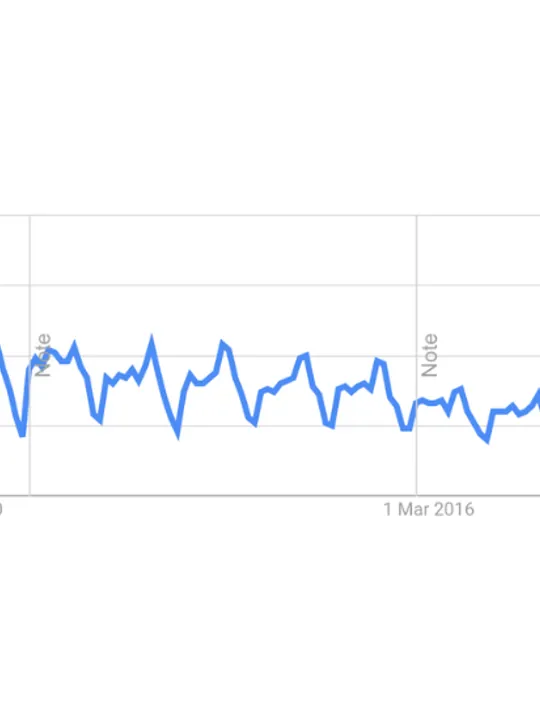

Glasgow

Kicking things off, when looking at searches in Glasgow, we can see that from 2004 to 2024, the graph shows a general downward trend in searches, with notable fluctuations around the 2020 period (coinciding with the COVID-19 pandemic). After that, there appears to be a significant drop in search volumes, followed by a relatively lower and steady trend, without a clear return to pre-pandemic levels.

This drop could be attributed to several factors

Impact of COVID-19 on tourism

During the pandemic, travel restrictions, lockdowns, and public health concerns heavily impacted tourism. Even after restrictions were lifted, international tourism to the UK has yet to fully recover. Many travellers are still cautious and some may have shifted preferences to domestic travel or alternative experiences. The UK’s reliance on international tourism has not bounced back to pre-pandemic levels, affecting search volumes for popular destinations.

Cost of living crisis

In the last few years following the pandemic, economic challenges, including inflation and a rising cost of living, may be deterring both domestic and international travel. Consumers are also cutting back on non-essential spending, such as leisure travel, which in turn is reflected in lower search interest in destinations across the board.

Change in consumer habits

The way people search for travel inspiration and plan their trips has also evolved. The rise of social media platforms like TikTok and the growing value of UGC and short-form content has changed the way travellers discover new destinations. Many are relying more on visual platforms for inspiration rather than traditional search engines which could explain part of the decline in Google searches for travel-related topics.

Recommendations:

Social media

Since TikTok and Instagram have become more popular for travel inspiration, you may want to consider encouraging content creators and influencers to highlight your destination, showing engaging experiences in short form videos to attract younger audiences and boost searches.

Promoting staycations

Focus on domestic travellers by marketing weekend getaways, staycations, and unique local experiences. Highlighting cost effective options might appeal to those impacted by the cost of living crisis and encourage more bookings.

Emphasise value for money

Emphasising affordable experiences shows consumers that they can still enjoy great travel experiences without overspending such as with offers, discounts, or package deals to help stimulate interest.

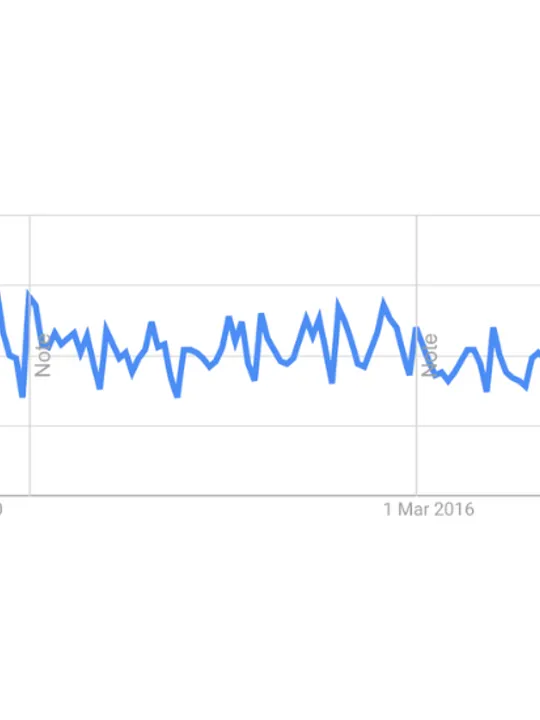

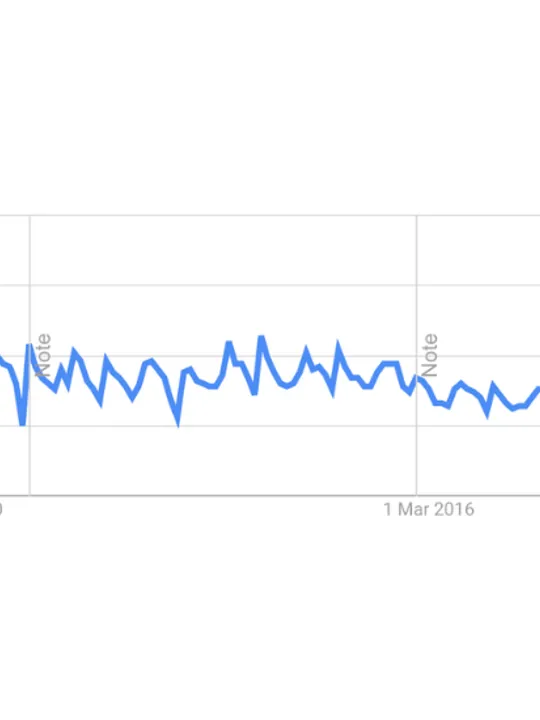

Bath

The next location focuses on searches in Bath. This graph shows a similar long term downward trend in search interest, with some peaks and troughs, but a clear drop off around the 2020 period (again coinciding with the COVID-19 pandemic), followed by lower post-pandemic search volumes. We can also see some highs following the 2020 period, which suggests that when travel restrictions eased, more searches were made to get in a break, however, this was followed by another trough as restrictions again tightened. From 2022 onwards, searches have continued, but not returned to the highs of previous years. This may indicate that despite the reopening of travel, consumer confidence and demand haven't fully bounced back, particularly for a more niche destination like Bath.

Contributing Factors

Reduced tourism

International tourism to the UK remains lower than pre-2020 levels. Bath, while a well known location, may be less of a priority for travellers now compared to major cities like London. The decrease in international tourists who often flock to cultural and historical destinations could explain the lower search volumes.

Cost of living

The rising cost of living in the UK has affected domestic travel as well. People are more budget conscious and may opt for shorter, closer to home trips or limit their leisure travel altogether. Bath is a city known for its luxury hotels and spa retreats, and therefore may be seen as a non-essential, indulgent expense that consumers are okay with cutting back on.

Shift in travel preferences

Consumer travel habits have shifted towards experiences over destinations. People may be seeking alternative travel experiences such as rural escapes, outdoor adventures, or wellness retreats, rather than traditional cultural tourism. Bath’s appeal as a historic landmark may not align as well with these new preferences, potentially resulting in lower search volumes.

Recommendations for Bath:

Promote new experiences

Highlight new or unique experiences in Bath, such as wellness retreats or sustainable travel options, to tap into current consumer interests. Promoting experiences beyond the typical historic tours could attract a broader audience.

Collaborate with influencers

Partner with influencers who can showcase Bath's timeless beauty in a modern context. Engaging visual content on social platforms can help boost interest among younger travellers and rekindle interest in the destination.

Highlight Bath as a wellness destination

Bath’s Roman baths and spa offerings could be emphasised, helping establish Bath in the niche of a wellness tourism destination which could appeal to consumers looking for relaxation and self-care experiences.

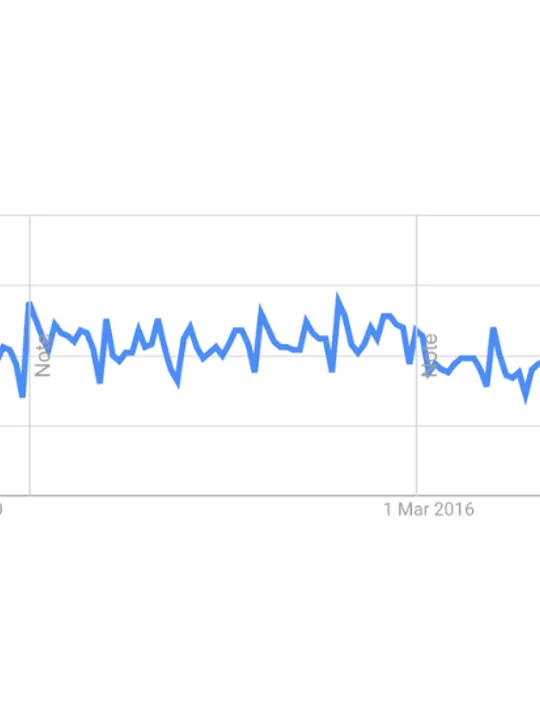

Cardiff

The above graph focuses on searches for hotels in Cardiff and shows a striking peak in the early years around 2004 and then a consistent downward trend, with post-2020 search volumes remaining lower than pre-pandemic levels. The huge spike in the early 2000s could be attributed to Cardiff hosting significant events, possibly related to international sports or cultural events (such as major rugby tournaments). After this peak, searches gradually declined but remained somewhat stable until the 2020 pandemic. Similar to other locations, there is a clear dip around 2020 due to COVID-19 restrictions and the massive disruption to travel. Searches have since recovered somewhat, but they have plateaued at a much lower level compared to earlier years, suggesting a long term shift in demand for Cardiff as a destination.

Contributing Factors

Tourism decline

International tourism in Cardiff might not have been as strong as in larger UK cities, but even domestic travel has suffered post-pandemic. Cardiff, while popular for sporting events and cultural tourism, may have seen a reduction in interest, especially as international travel markets have been slow to recover.

Event-driven traffic

Cardiff’s reliance on large events, such as rugby matches at the Principality Stadium, could explain the fluctuation in search traffic. Since many large events were cancelled or limited during COVID-19, and fewer are scheduled in the near future, this could account for the lower sustained search interest.

University population

Cardiff has a perception of being a university destination, and as such, with a large population of university-age people, this may make it a slightly less desirable travel destination for international markets who would favour going somewhere like London or Oxford.

Shifting travel preferences

Like with Bath and other UK cities, consumer travel preferences may have shifted toward rural getaways, nature retreats, and experience-based travel rather than traditional city breaks. Cardiff, though vibrant, may be overlooked in favour of more “Instagrammable” destinations.

Recommendations to Boost Interest in Cardiff:

Targeted event marketing

Businesses in Cardiff could focus on marketing upcoming events, including sports, festivals, and concerts, to reignite interest among travellers. Highlighting Cardiff’s lively event scene, diverse nightlife and its cultural richness could help attract visitors who may not have Cardiff on their radar.

Positioning as a staycation destination

Like many UK cities, Cardiff could benefit from marketing staycations. Promoting Cardiff as an affordable, accessible city with vibrant nightlife, shopping, and heritage can appeal to domestic travellers seeking an easy getaway.

Promote outdoor and adventure options

While known for its city life, Cardiff is also close to the coast and countryside. Marketing Cardiff as a gateway to outdoor adventures or day trips could tap into the current trend of combining city and nature experiences.

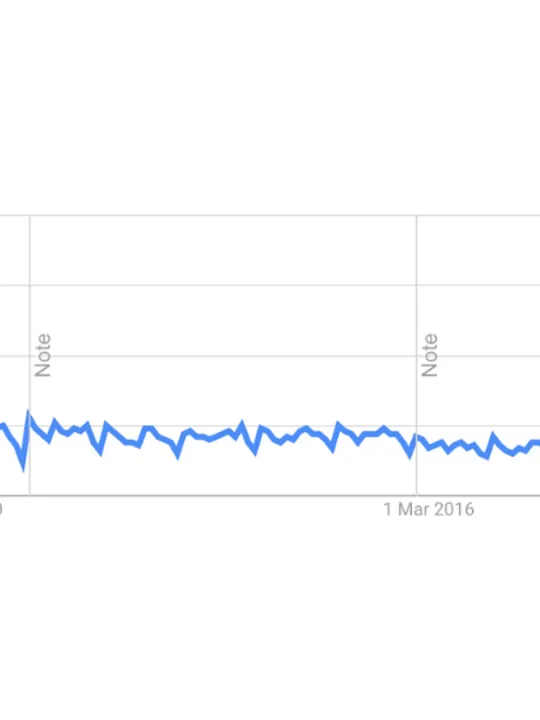

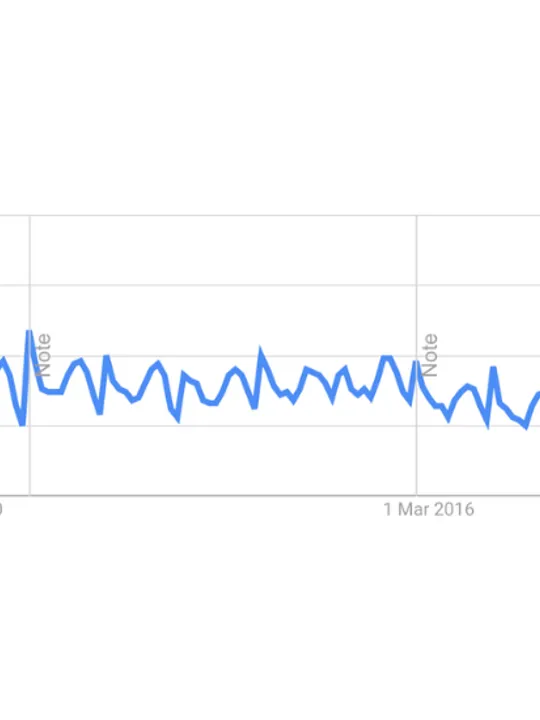

Blackpool

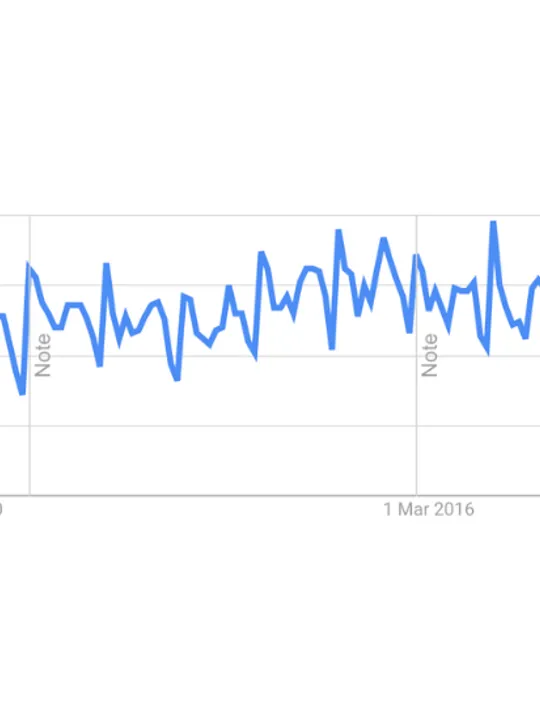

The above graph for hotel searches in Blackpool shows a consistent repeating pattern of peaks and troughs, with a clear annual rhythm that suggests strong seasonality in searches. However, the overall trend also shows a steady decline over the years, with a notable drop around 2020, after which search volumes have not returned to pre-pandemic levels.

The consistent peaks and valleys indicate that Blackpool definitely experiences predictable seasonal surges in searches, likely during the summer months and possibly around other key holiday periods. However, this is not surprising as Blackpool is a seaside destination in the UK, and its tourism appeal is closely tied to warm weather, school holidays, and traditional British holiday patterns.

As seen in the other graphs, 2020 marks a sharp decline in search interest due to the COVID-19 pandemic. While there is some recovery post-pandemic, the overall search volume for Blackpool remains lower than in earlier years. This indicates that the location has been slow to regain its previous levels of tourist interest.

Contributing Factors:

Reduced domestic tourism

Blackpool’s reliance on domestic tourism may have been a double edged sword during the pandemic. While many UK travellers turned to domestic destinations during COVID-19 travel restrictions, the economic pressures post-pandemic (rising living costs, inflation) may have deterred many from making the kinds of trips they previously would.

Changing travel preferences

Like other traditional tourist spots, Blackpool might be suffering from shifting travel preferences. Travellers are now seeking more unique or experience-driven destinations rather than traditional seaside holidays. The rise in popularity of "Instagrammable" locations and nature retreats may have drawn attention away from places like Blackpool.

Cost of living crisis

Blackpool has traditionally been seen as a budget-friendly destination but with the current economic situation, even affordable trips may be out of reach for many families. Hard times have fallen on shoulders across the UK, and for those who have already favoured a budget-friendly trip, this may mean they have to negate a trip entirely.

Recommendations for Blackpool

Modernise the brand

Blackpool’s image as a traditional seaside destination might benefit from a refresh. Marketing efforts could focus on showing Blackpool as a vibrant, fun place for a variety of audiences, not just families. Highlighting new attractions, events, or developments could help rejuvenate interest and encourage more travellers outside of its usual market.

Promote unique experiences

Blackpool has the advantage of being a classic British seaside town, therefore, emphasising unique experiences, such as nostalgia for traditional holidaymakers or quirky, modern experiences like themed events, can attract both older and younger tourists.

Enhance off-season offerings

While Blackpool's appeal is clearly seasonal, there is potential to promote it as a year-round destination by offering winter festivals, indoor attractions, and themed events during off-peak months. This could help flatten the troughs in the search pattern and bring in visitors during quieter times.

Value-driven travel

Given the current economic climate, Blackpool could focus on promoting itself as a value for money destination, offering deals on accommodation, food, and entertainment that cater to those on a tighter budget. A campaign focused on affordability without compromising on the fun factor could help attract families and individuals looking for affordable getaways.

Brighton

The graph for searches related to hotels in Brighton shows a clear long term downward trend, with notable fluctuations in search interest over time. It follows a similar pattern to other locations, with a sharp decline around the COVID-19 period, followed by a modest recovery but, as with the other destinations, without reaching previous peak levels.

Brighton’s search volume shows a fairly steady decline from 2004 to 2020. The early years of the graph display periodic peaks, likely aligned with seasonal tourism during the summer months and major events. As a seaside city with an established appeal for both leisure tourists and event-goers, Brighton’s popularity appears to have diminished over the years. Like other cities, searches for Brighton hotels fell significantly during the COVID-19 pandemic. While there has been some recovery in the years since, search interest remains lower than in pre-pandemic years, suggesting the city is struggling to return to its previous tourism levels.

Contributing Factors:

Changes in domestic tourism

Brighton has traditionally been a favourite for short weekend trips, summer holidays, and events. However, the overall decline may indicate that travellers are now seeking alternatives, including less commercialised seaside towns or international destinations as restrictions eased.

Rise in competing destinations

Brighton may face increasing competition from other UK destinations that are either perceived as more affordable or offer a different kind of appeal. With a stronger preference for nature-based or unique experiences, some travellers may be turning to quieter coastal areas or more rural destinations.

Shift in consumer preferences

Post-pandemic, there has been a shift in preferences with some rise in interest in wellness tourism, nature escapes, and outdoor adventures, which may not align perfectly with Brighton’s urban and seaside mix. Brighton’s identity as a city break destination may not fully capture current trends toward eco-tourism or sustainable travel experiences and as such, is seeing fewer searches.

Recommendations for Brighton

Emphasise Brighton’s unique appeal

Brighton is known for its bohemian vibe, vibrant arts scene, and quaint coastal location. Focusing marketing efforts on what makes Brighton different from other UK cities, such as its LGBTQ+ friendly community, independent shops, and quirky events, could help reignite interest and attract new audiences.

Wellness and sustainable tourism

As wellness and sustainable tourism continue to grow, Brighton could position itself as a destination for eco-conscious travellers. Highlighting its proximity to natural beauty spots like the South Downs, as well as promoting eco-friendly accommodations and wellness experiences, could help attract this audience.

Leverage social media and events

Brighton’s appeal to a younger, more culturally engaged audience could be amplified through hotel social media marketing campaigns and influencer partnerships. Promoting events such as the Brighton Festival, Pride, or other cultural happenings on platforms like TikTok and Instagram can boost visibility and attract a modern audience.

Extend Brighton’s seasonality

While summer is traditionally the most popular time to visit Brighton, the city could focus on marketing itself as a year-round destination. Promoting its winter appeal (holiday markets, cosy seaside stays) or special events during the off-season can help balance the peaks and troughs in search interest.

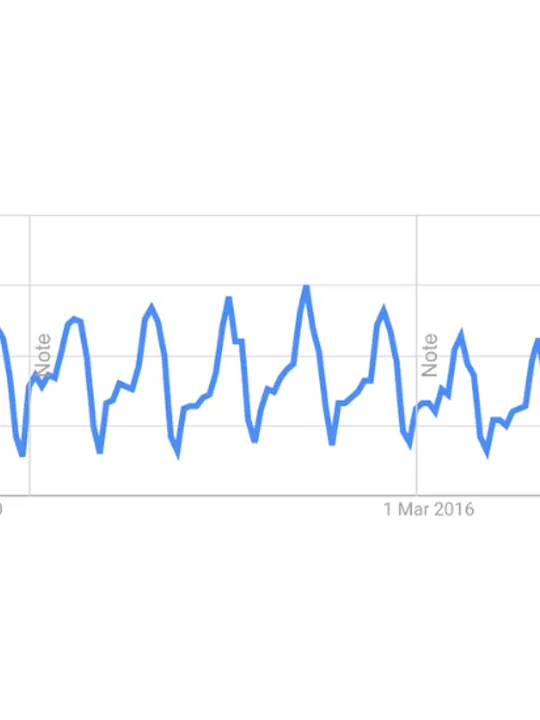

Edinburgh

For Edinburgh, the above graph shows a similar long term downward trend as seen in other UK locations. However, there are consistent fluctuations, with notable peaks and drops that suggest some seasonality or event-driven spikes in interest. After the significant drop in 2020 due to the COVID-19 pandemic, search volumes remain below pre-pandemic levels, though some recovery is visible.

Prior to 2020, the graph shows a series of peaks and valleys, which is expected as Edinburgh is a major tourist destination, particularly around the time of events like the Edinburgh Festival Fringe and Hogmanay (New Year’s Eve celebrations). These events would drive spikes in hotel searches, but the overall trend points to a gradual decrease in search volumes over the years. As with other cities, the pandemic led to a steep drop in searches for hotels in Edinburgh in 2020. The city relies heavily on international tourism and large-scale events, both of which were severely disrupted by COVID-19. Post-2020, while there is some recovery, search volumes remain lower than in previous years, indicating that tourism has not yet fully bounced back.

Contributing Factors

Event-driven traffic

Edinburgh is known for hosting some of the world’s largest cultural events, such as the Edinburgh Festival Fringe and Hogmanay. The pandemic caused many of these events to be cancelled or scaled down, which likely contributed to the significant drop in hotel searches. Although events have resumed, this may still only offer a seasonal spike, rather than consistent search traffic.

Changing travel trends

Post-pandemic, there has been a notable shift toward travel destinations that offer outdoor experiences, wellness retreats, and less crowded locations. Edinburgh, while rich in culture and history, may not align perfectly with these new travel preferences, as it’s a city-based destination that thrives on busy festivals and cultural gatherings.

Cost of living and travel

Edinburgh is a popular destination, but it can also be perceived as expensive, particularly in the accommodation sector. With the current economic climate and cost of living crisis, many travellers may be opting for more affordable destinations or postponing trips altogether.

Recommendations for Edinburgh

Highlight year-round appeal

Edinburgh can market itself as a year-round destination, focusing not only on major events but also on its history, architecture, and natural beauty. Promoting off-peak travel options and winter city breaks, such as visiting Edinburgh Castle, the Royal Mile, and nearby nature reserves, can help flatten the seasonality curve and attract visitors during quieter months.

Target value-driven travellers

With economic pressures in mind, Edinburgh could focus on promoting budget friendly accommodations, dining options, and itineraries. Marketing the city as an affordable yet enriching cultural destination could appeal to travellers looking for value in their trips.

Leverage digital channels

Edinburgh already has a strong visibility on platforms like Instagram and TikTok, showcasing its beautiful landscapes, architecture, and iconic spots. Further engaging influencers to highlight the city’s appeal can help attract younger, digitally savvy travellers.

Manchester

Manchester’s graph displays a similar pattern to other UK cities with initial fluctuations and notable peaks, as well as a gradual decline over time and a significant drop in 2020 due to the pandemic. Although there is some recovery after 2020, the search volume remains below previous levels. Pre-2020, the graph shows periodic peaks and troughs in search interest, indicating Manchester’s strong appeal as a destination for both business and leisure. The city is known for major events, concerts, sporting events, and its vibrant nightlife, all of which likely contribute to the cyclical spikes. However, over the years, the trend shows a gradual decline, which may be linked to broader shifts in travel habits or increased competition from other destinations.

The sharp decline in searches around 2020 can be attributed to the COVID-19 pandemic. Manchester, being a hub for conferences, business travel, and major sporting events (like football matches), would have seen a massive drop in demand due to travel restrictions and event cancellations. While there is some recovery post-pandemic, searches haven’t returned to pre-2020 levels.

Contributing Factors

Event-driven traffic

Manchester’s appeal is closely tied to large events, concerts, football matches, and conferences. The cancellations and reduced capacity of such events during the pandemic likely contributed to the steep drop. Although events have returned, the slower recovery of international travel and general caution around large gatherings may be holding back a full rebound in hotel searches.

Shift in business travel

Business travel is an important factor for Manchester’s hotel industry and has undergone significant changes since the pandemic. Remote working and virtual meetings have reduced the need for travel, and companies may be cutting back on corporate trips as part of cost saving measures.

Competition from other cities

Manchester competes with other UK cities like London, Birmingham, and Liverpool for both domestic and international visitors. Changing preferences in travel, such as an increased interest in nature-based, rural, or coastal destinations, may have drawn attention away from Manchester as a typical city-break destination.

Recommendations for Manchester:

Promote Manchester’s diverse appeal

Manchester is a city with a rich cultural scene, sports legacy, and thriving music and nightlife. By focusing on these strengths, Manchester can appeal to a wide range of audiences. Marketing campaigns that emphasise key events (football matches, concerts, festivals) and cultural offerings (art galleries, historical sites) can also help drive search interest.

Target event-based and festival tourism

Manchester could benefit from ramping up marketing efforts around its major events, such as Manchester Pride, the Manchester International Festival, and football matches involving Manchester United and Manchester City. Targeting both domestic and international tourists for these events can help reinvigorate interest.

Focus on affordable city breaks

In light of the current economic climate, Manchester could position itself as a more affordable city break option compared to London or other larger cities. Offering special deals, midweek discounts, or family-friendly packages could attract budget conscious travellers.

Promote hybrid travel

With the rise of remote work and hybrid travel, Manchester could position itself as an ideal city for "workcations." Offering hotel packages with business-friendly amenities, co-working spaces, and leisure activities could attract digital nomads and professionals looking to blend work with play.

York

The graph for hotel searches in York shows a clear downward trend over the years, with a series of peaks and troughs. Like other UK locations, there is a noticeable drop around 2020. Despite some recovery, the search interest remains lower than pre-pandemic levels. The graph also displays periodic peaks, indicating that York experiences seasonal surges in demand, likely related to school holidays, summer holidays, and holiday periods like Christmas. York is a historic city known for its medieval architecture, museums, and cultural attractions which make it a popular destination for both domestic and international tourists. However, the long term trend shows a steady decline in search interest, which might reflect changing travel patterns and increased competition from other destinations.

As expected, the 2020 period saw a sharp decline in searches due to the global travel restrictions during the pandemic. Although searches have somewhat recovered since they have not returned to the levels seen in previous years.

Contributing Factors

Tourism decline

York’s popularity as a historical and cultural destination has been affected by the pandemic, with both domestic and international tourism taking a hit. As travel restrictions were lifted, people may have opted for destinations closer to nature or quieter rural escapes instead of historic city breaks, reducing the overall interest in York.

Competition from other cities

York faces competition from other heritage cities in the UK, such as Bath and Edinburgh. Additionally, the rise of cheaper international travel may have diverted attention from UK-based city breaks to overseas destinations, further reducing demand.

Economic factors

The ongoing cost-of-living crisis and inflationary pressures have caused many travellers to cut back on leisure trips. York, while known for its charm and history, may be seen as an extra expense for travellers who are more price-conscious during difficult economic times.

Change in travel preferences

There has been a shift in consumer preferences toward nature-focused, wellness, or unique experiences. York’s focus on history and cultural tourism might not align perfectly with current trends, leading to a dip in interest.

Recommendations for York:

Promote York’s unique experiences

York is rich in history, with attractions such as York Minster, the Shambles, and its medieval walls. To reignite interest, marketing efforts could focus on the city’s unique selling points, such as ghost tours, historical reenactments, or lesser-known landmarks that offer an immersive experience.

Embrace off-peak travel

While York has a clear peak in the summer months and around holidays, the city can promote itself as a year-round destination. Highlighting off-peak activities like cosy winter breaks, indoor attractions (museums, galleries), and special events can encourage visitors outside the traditional peak seasons.

Social media

Like other UK cities, York could increase its social media visibility. Engaging influencers, bloggers, and travel content creators to showcase York’s charm, history, and hidden gems can appeal to younger audiences. Recently, York has seen a lot of traffic for its ghost shop. Using tactics like this to showcase its unique and spooky setting could encourage more visitors.

Liverpool

Liverpool’s graph shows periodic fluctuations with distinct peaks, likely reflecting seasonality and event-driven demand. As with the other UK cities, there is a significant drop in search interest around 2020 and although some recovery is visible, the trend has not fully returned to pre-pandemic levels.

The graph shows regular peaks and troughs, suggesting that Liverpool experiences surges in hotel searches around key events, holidays, and possibly during the football season. Liverpool is a major tourist destination due to its cultural heritage, waterfront attractions, and strong football culture. The overall trend is somewhat steady, though there are fluctuations that align with key events. However, there is no significant long term growth, indicating some stagnation in demand.

Similar to other cities, the COVID-19 pandemic led to a steep decline in searches for Liverpool hotels in 2020. Although there has been some recovery since, search interest has not returned to the levels seen before the pandemic, reflecting lingering effects on tourism and travel demand.

Contributing Factors

Event-driven traffic

Liverpool’s search peaks are likely tied to key events, such as football matches, concerts, festivals (e.g., Liverpool Sound City), and other large-scale cultural attractions. As many of these events were cancelled or scaled down during the pandemic, demand for hotel stays in the city has not fully bounced back.

International tourism decline

Liverpool has a strong international appeal, especially among music and football fans. The slow return of international tourists could be a major factor in the reduced search volumes post-pandemic. This trend may be exacerbated by ongoing travel restrictions in some regions and economic concerns globally also.

Competition from other cities

While Liverpool is a popular UK destination, it competes with other urban destinations like Manchester, London, and Edinburgh. A shift in consumer preferences toward nature-focused or rural escapes may have also drawn attention away from urban centers like Liverpool with more consumers opting for more rural escape.

Recommendations for Liverpool

Event and football tourism

Liverpool is known for its football culture, with two major clubs (Liverpool FC and Everton FC) attracting both domestic and international tourists. The city should continue promoting football-related tourism, offering hotel packages for match days or football-themed city tours. Similarly, promoting events like music festivals, concerts, and exhibitions will help boost demand during peak times.

Attract international visitors

As international tourism gradually returns, Liverpool should focus on key markets, particularly those with strong cultural ties to the city (e.g., Beatles fans, football fans). Marketing campaigns that highlight Liverpool’s unique appeal, such as its UNESCO World Heritage waterfront and vibrant music scene, can help draw international visitors back and prompt them to book stays.

Utilise social media and influencers

Engaging influencers and content creators who can showcase Liverpool’s cultural hotspots, nightlife, and football culture can boost visibility among younger travellers and those who value UGC/influencer content. Social media campaigns that highlight the city’s vibrant atmosphere, history, and unique attractions can help reignite interest with more consumers enjoying visual content.

Highlight Liverpool’s waterfront and cultural appeal

Liverpool’s waterfront is a key part of its UNESCO World Heritage status. Marketing campaigns should emphasise the city’s architectural beauty, waterfront attractions, and unique cultural heritage. Promoting Liverpool’s association with The Beatles and the city’s strong music legacy could help differentiate it from other urban destinations and align itself in a cultural niche.

Get in touch

We hope you found the above information incredibly useful, and if your business resides in any of these locations, we hope our suggestions offer some food for thought on how you can utilise marketing to pick up some more traffic that is actively searching for your product. Alternatively, if you’d like to discuss the hotel marketing aims of your business in a little more detail, get in touch today and we can help every step of the way.